Contents:

You are advised to be cautious when browsing on the internet and to use good judgment and discretion when obtaining information or transmitting information. From this Website, users may visit or be directed to third party web sites. The Website makes no effort to review the content of these web sites, nor is the Website or its licensors responsible for the validity, legality, copyright compliance, or decency of the content contained in these sites. There are no charges or fees to be paid by you for use of this Website. However, you are responsible for all telephone access fees and/or internet service fees that may be assessed by your telephone and/or internet service provider.

To ensure smooth settlement of https://1investing.in/s, the investors are requested to ensure that both the trading and demat accounts are compliant with respect to the KYC requirement. The demat account shall be unfreezed once the investor submits the deficient KYC details and the same is captured by the depository participant in the depository system. Sytematic filtering of mutual funds across asset classes and criterias to suit your investment needs. Financial indicators such as dividends and split-offs are not considered in the market capitalization figure of a stock.

TRADEBULLS SECURITIES PRIVATE LIMITED

For instance—let’s say—rather than opting for stocks randomly, an investor opted to select stocks from different market cap categories—the small-cap, medium-cap, and large-cap. Suppose, the portfolio now gets affected due to an economic downturn or unavoidable market fluctuations. There are various factors impacting a company’s market capitalization. Unlike the financial indicators such as net profit, liabilities, and assets shown in the financial reports of the company, the market capitalization won’t remain the same for the quarter.

The particular measures and multiples used by the analyst might affect market valuations. HCL Tech, ABB India among 6 stocks to trade ex-dividend this weekIT major HCL Technologies will trade ex-dividend on Friday with an interim dividend of Rs 18 per share (900% of face value). Shares of HCL Technologies rose 1% to Rs 1,049 apiece on BSE in Friday’s trade. Chinese small-cap stocks surge in meme-like rallyShares in small and micro-cap Chinese firms that are listed in the US soared on Friday, echoing rallies of last summer fuelled by individual traders.

The categorization of these stocks helps the investors to make effective decisions while investing their funds in the stock market. Meanwhile, mid-cap stocks are slightly more volatile than large-cap stocks. On the other hand, small-cap stocks are highly volatile, which increases the risk for investors.

What Are Small-cap Stocks?

These are meant for general information only or to meet statutory requirements or disclosures. ABCL or any of its employees are in no way liable for the use of the information by you, when making any decision or investing or trading through any investment vehicles or ABC Companies, or any other third party which may be engaged in offering of these services. To help you for your money needs you can avail the facility of MoneyForLife Planner (‘MoneyForLife Planner/ Planner’). MoneyForLife Planner facility is powered by Aditya Birla Money Limited, a subsidiary of ABCL. The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you.

- Investments in securities market are subject to market risk, read all the related documents carefully before investing.

- Besides, they usually have been functioning for decades and have a good reputation.

- All efforts have been made to ensure the information provided here is accurate.

- An Indian company whose market capitalization is less than Rs 5,000 crores are known as small-cap companies.

But it can help you understand how a company compares with its peers. It allows investors to see how big one firm is in comparison to another. Because it reflects what investors are prepared to pay for its stock, the market cap evaluates what a firm is worth on the open market, as well as the market’s view of its future prospects. Non-monetary assets and liabilities or debts are subtracted from a company’s total assets to arrive at the book value. The book value of a firm may differ from its market value or market capitalization.

Your fiwhat is basic salary difference between gross payt installment will be deducted from ledger & subsequent from the bank. The year was marked with high inflation, coupled with big events, including the Russia-Ukraine war, Adani Group saga and banking crisis in the US towards the fag-end of the year, which impacted the market the most. The non-compliant demat accounts will be frozen for debits by Depository Participant or Depository. Thereafter non-compliant trading accounts will be blocked for trading by the Exchange. Keeping some of the common issues faced by traders in mind, Tradebulls introduced a couple of popular online series; ‘Market bloopers’ and ‘Learning series’, which are available on YouTube, Facebook, Instagram, Twitter and LinkedIn. The purpose behind creating these 2 series is to disrupt the myths about ‘trading’ and teach about ‘how to trade’ respectively.

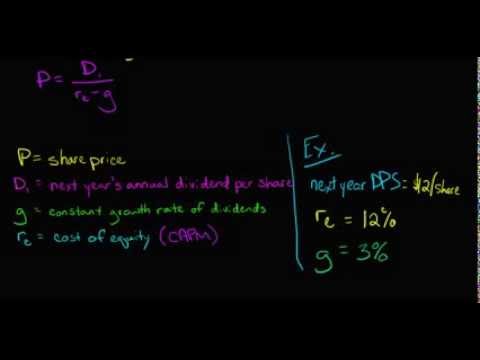

There are multiple criteria that investors have to look into before investing in any company. Market capitalization refers to the total market value of the shares of a listed company. In other words, it is equal to the market price or current price per share multiplied by the number of outstanding shares.

How to calculate market capitalisation?

An example can demonstrate the calculation of market capitalization with more ease. If a company has 10,000 shares, each with a closing price of Rs.100; the total MC of the company would be computed as follows. The categorization of companies by size is mostly needed in the Fund management industry and this helps the investors to know what kind of stocks a particular fund will be buying / selling. A basket is a group of stocks or mutual funds handpicked under a trending theme.

Just a few stocks are behind the market’s recent resilience. A real … – CNBC

Just a few stocks are behind the market’s recent resilience. A real ….

Posted: Sat, 29 Apr 2023 13:01:03 GMT [source]

Market capitalization is used to categorize the stocks of companies to help investors pick them according to their risk profile. The above categories have been defined as per SEBI guidelines and they are based on the ranking of the companies on the Stock Exchange. The Association of Mutual Funds in India publishes a list at regular intervals to highlight which stocks fall in each category. The average trading price from a fixed time period is used for categorization of companies by size. Aradhana Gotur is a Content Writer with 4 years of experience in personal finance, stock markets, and lifestyle areas.

Mirza International has rallied 88% in last six trading sessions

As per SEBI guidelines, Mutual Funds which manage the money of the general public, have to allocate the cash based on the category of the fund and the objective of the fund. Please provide your consent for transfer of trading account from Reliance Commodities Limited to Reliance Securities Limited to trade in commodities’. In case you do not provide consent now & wish to trade in commodities you will have to re login to the application to provide your consent. In case of any dispute between the Participants and the investors arising out of this facility, NSEIL/BSE and / or NSCCL/ICCL agrees to extend the necessary support for the speedy redressal of the disputes. The Client has read and understood the risks involved in investing in MUtural Fund Schemes.

Adding Possible AI-Play Zedge To My Value Portfolio (NYSE:ZDGE) – Seeking Alpha

Adding Possible AI-Play Zedge To My Value Portfolio (NYSE:ZDGE).

Posted: Sun, 30 Apr 2023 04:38:11 GMT [source]

Investors’ valuations or multiples of companies, such as price-to-sales, price-to-earnings, enterprise value-to-EBITDA, and so on, define market value. In addition to stockholder equity, these various indicators take into consideration outstanding bonds, long-term growth potential, company debt, taxes, and interest payments. A simple statistic based on stock price is market capitalization or market cap. Multiply the number of outstanding shares by the current price of a single share to get a company’s market cap. From a new age company which after remaining under pressure for a long time has seen an improvement in its score, to a specialty chemical company have made to the list. These large cap companies have shown an improvement in their SR score even in volatile times and their stock price has gained.

Besides this, the term micro-cap are also used for very small companies. Small-cap companies are those that have a market capitalisation of less than Rs 5,000 crore. These companies are relatively smaller in size and have significant growth potential. What makes them risky is the low probability that they will be successful over time. Small-cap companies have a long history of underperformance but when an economy is emerging out of a recession, small-cap stocks often prove to be outperformers. Your investment risk in the stock market is closely related to volatility.

You are advised to read the respective offer documents carefully for more details on risk factors, terms and conditions before making any investment decision in any scheme or products or securities or loan product. You can use execution platform/services with any third party as deem fit and proper, and there is no compulsion to use the execution services through this Website. The growth potential of large-cap stocks is lower than that of mid- and small-cap stocks. That being said, large-cap stocks are a stable investment option, especially if you have a longer investment horizon. This makes large-caps well suited to investors with low risk appetites.

LVHM becomes 1st European company to cross $500 billion market cap

Also, market capitalization allows investors to understand the relative size of one company versus another. The market capitalization of a firm can provide investors with an indicator of the company’s size and can even be used to compare the size of two companies. Market capitalization, in general, corresponds to a company’s stage of development. Large-cap stock investments are typically more conservative than small-cap or mid-cap stock investments, perhaps providing less risk in exchange for less aggressive growth potential.

It’s because the stock price for that particular company fluctuates too. It is therefore imperative that an investor ought to perceive the factors that impact the market capitalization of a particular stock. An Indian company whose market capitalization is less than Rs 5,000 crores are known as small-cap companies. The stocks issued by these small companies are called small-cap stocks. The stocks that are active in the stock market are generally categorized based on the company’s market capitalization and are known as large-cap, mid-cap, and small-cap stocks.

We may provide you with various money solutions and options which are generally available basis your investment profile or those which are generally held by persons of similar investment profile. You authorize us to use/disseminate the information to provide the Financial Solutions however it is not necessarily for you to act on it. It only serves an indicative use of information which you may execute in the manner agreed by you. You also acknowledge and agree that, unless specifically provided otherwise, these Terms of Use only apply to this Website and facilities provided on this Website. This Agreement describes the terms governing the usage of the facilities provided to you on the Website.

Measuring a stock’s value with the enterprise value

In addition, the Website welcomes your feedback as a user of the facilities. The Website shall have a worldwide, royalty-free, non-exclusive, perpetual, and irrevocable right to use feedback for any purpose, including but not limited to incorporation of such feedback into the Website or other Website software or facilities. This Website may be linked to other websites on the World Wide Web that are not under the control of or maintained by ABCL.

These stocks are less volatile in comparison to mid-cap and small-cap stocks, and lower volatility makes them less risky. However, since they come with low-risk, the returns here can be relatively lower than mid and smallcap stocks. Mid-Cap stocks possess a market capitalization that ranges from $2 billion to $10 billion. They are considered to be less risky—if compared to the small-cap stocks. This category is inclusive of the stocks that are experiencing growth in the industry or are expected to do so. Further, they might be in the process of increasing the market share and differentiating themselves to stay peculiar from the herd in order to diminish its competitiveness to an extent.

Midcap stocks for the most part fall between enormous covers and little covers on the risk/bring range back. Therefore, midcaps may offer more development potential than huge covers. For instance, the market cap of NEPSE equals the total market cap of all the companies trading on NEPSE combined—the aggregate of banking, hydropower, microfinance, finance, life insurance, mutual fund, and the remaining seven sectors trading on NEPSE.

As Top Glove Corporation Bhd.’s market cap (KLSE:TOPGLOV) drops to RM7.8b, insiders might be questioning their decision to buy earlier this year – Simply Wall St

As Top Glove Corporation Bhd.’s market cap (KLSE:TOPGLOV) drops to RM7.8b, insiders might be questioning their decision to buy earlier this year.

Posted: Sun, 30 Apr 2023 00:50:45 GMT [source]

Hence, investors are more attracted and favorable towards mid-cap companies. Mid-caps are suited for investors with a risk appetite that is moderate, these have a slightly higher potential for growth. The market cap of mid-cap companies is between Rs 5,000 crore and less than Rs 20,000 crore while the small-cap companies have a market cap of below Rs 5,000 crore. These Terms of Use and any notices or other communications regarding the Facilities may be provided to you electronically, and you agree to receive communications from the Website in electronic form. Electronic communications may be posted on the Website and/or delivered to your registered email address, mobile phones etc either by Facilities Provider or ABC Companies with whom the services are availed.

Financial market participants classify corporations depending on their market capitalization. Because they have a lot of opportunities to develop, these stocks have the potential to generate fast and substantial returns, but their size also makes them hazardous. Market capitalization, often termed as market-cap is the market value of the outstanding shares of a company. To put it in simple words, it is the market value of all the shares that are held by a company’s shareholders. For example, if ABC company has 10 million outstanding shares with a market value of RS.150 each, then the market cap of ABC company would be RS.150 Crore. Investors use this number to figure out the market size of the company.

ET screener powered by Refinitiv’s Stock Report Plus lists down quality stocks with high upside potential over the next 12 months, having an average recommendation rating of “buy” or “strong buy”. The investors are hereby requested to comply with the regulatory guidelines issued by Exchanges and Depositories from time to time with regard to KYC compliance and related requirements. Huge free-floating shares have less volatility in their shares as more shares are traded in the market, and less individuals have the ability to increment or lessening the share price essentially.

Either way, before you invest, it is always good to quickly do a bit of research into the market cap and the enterprise value of a company. Fundamental analysis to arrive at the value of a stock can also help you make informed investment decisions. The market cap gives you an overall idea about the value of a company. It is frequently used in fundamental analysis, which helps you arrive at the value of a stock. By itself, the market cap may not give you the exact value of a stock.